Shorts Create

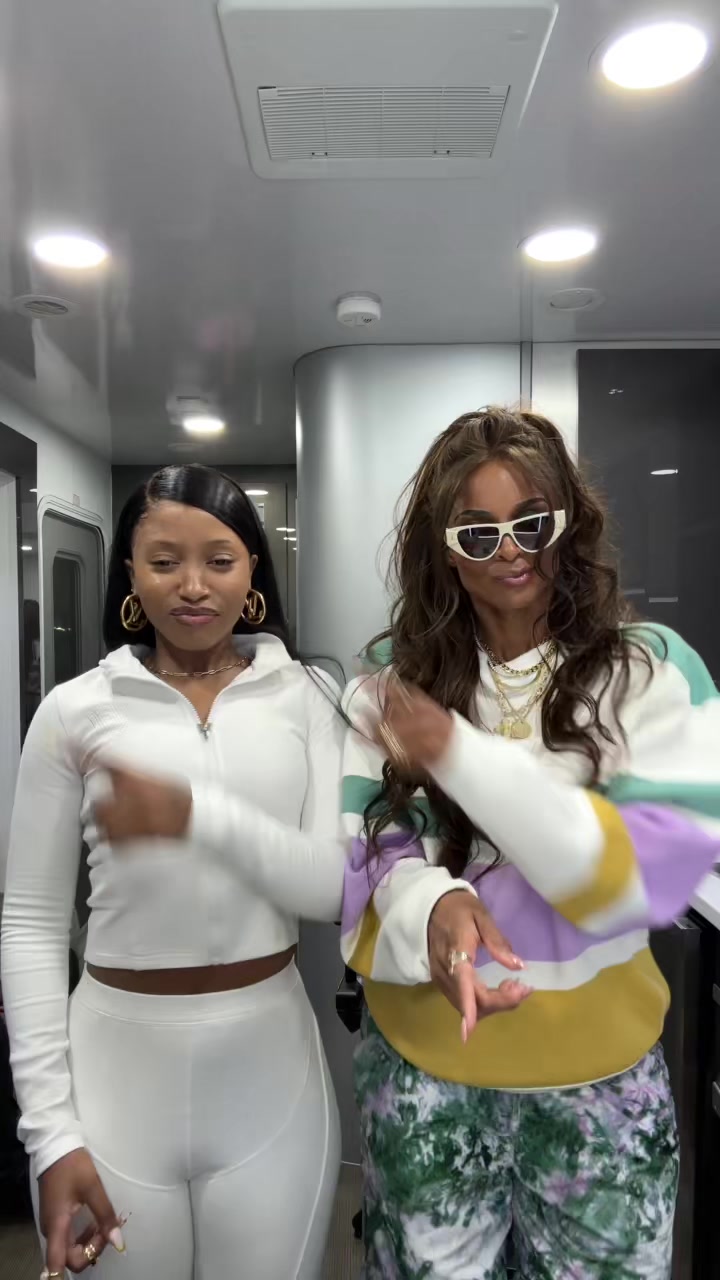

Fitness is better when shared with friends! I was soo excited to workout with @melanin_lelo and support her journey to building lean muscles with HITT workouts! And I cannot wait to see her shine on the pageant stage! #fitness #fitnessmotivation #hitt #workoutmotivation #fitness #sama28 #fitnessjourney #trendingvideo

Comments

Show more